For processing vendor invoices using EDI in intercompany billing scenario, the necessary customizing settings needs to be done.

Detailed steps are shown below:

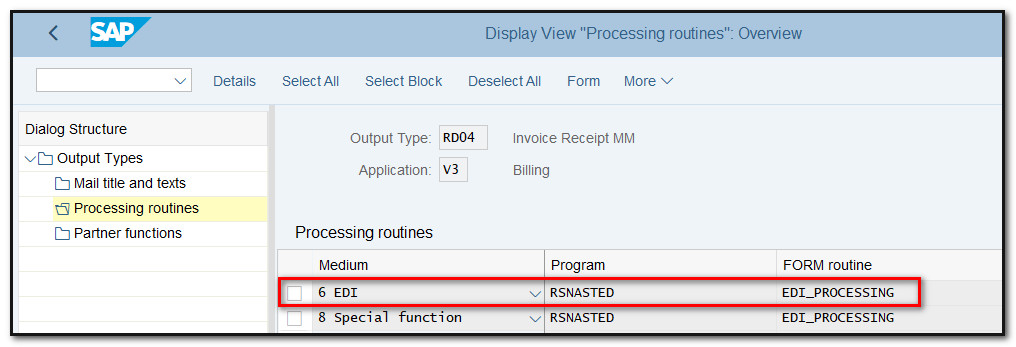

Step 1: Check the output type settings (T-code NACE).

Figure 1 Processing Routine for output RD04

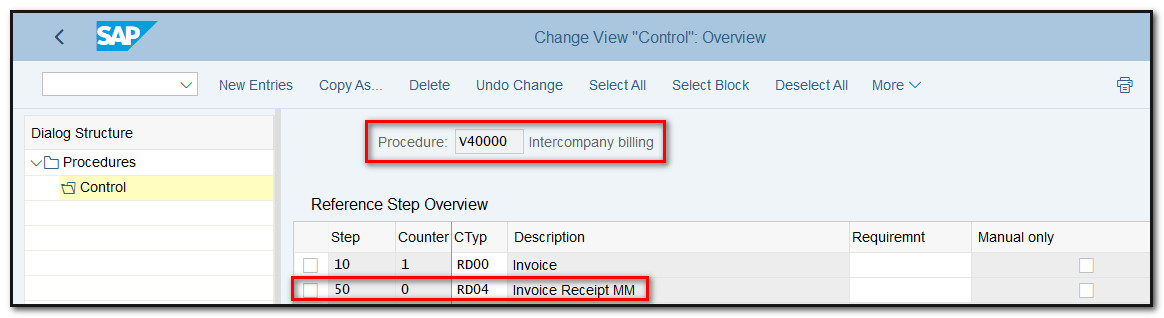

Step 2 : Check output determination procedure settings (T-code: NACE).

Figure 2 Output Determination Procedure for Intercompany Billing

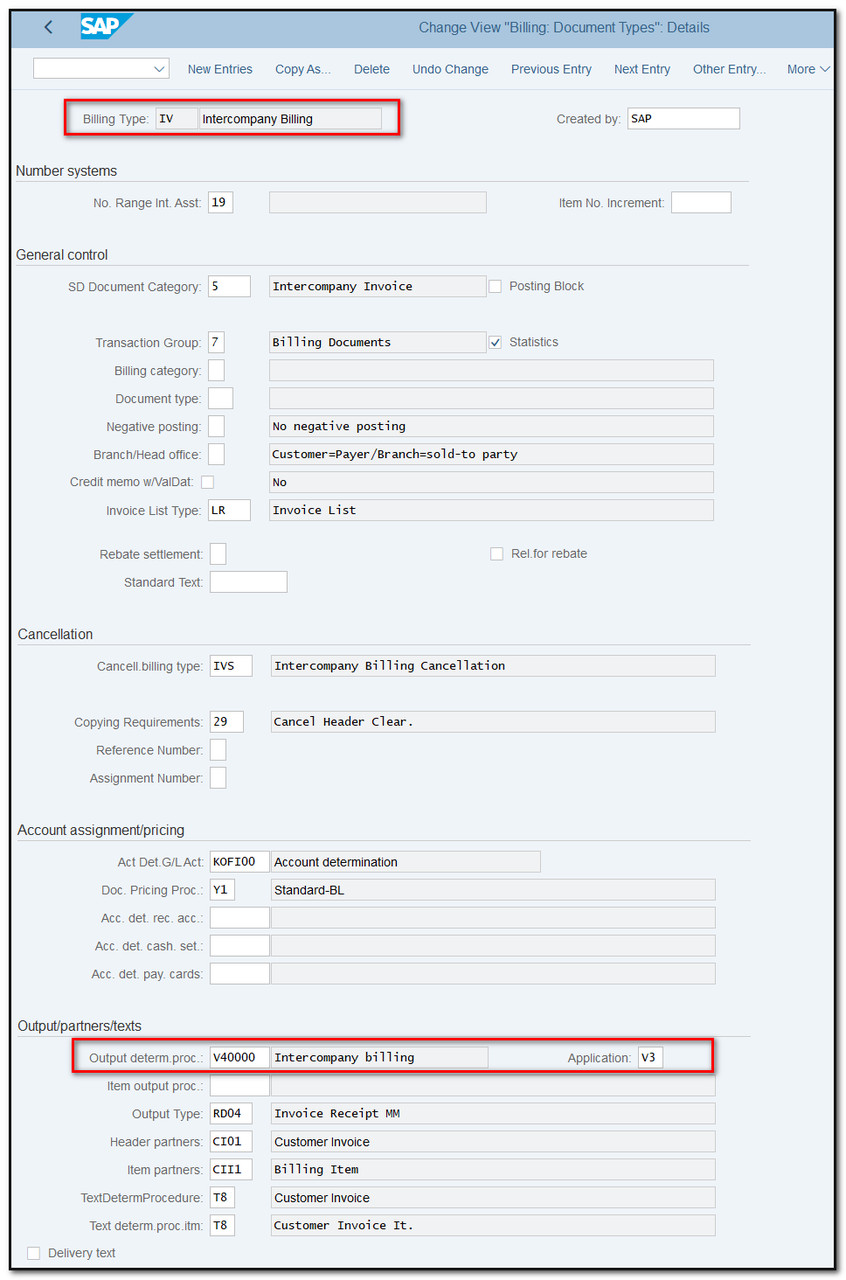

Step 3 : For billing type IV, procedure V40000 should be assigned (T-code: VOFA).

Figure 3 Document type for Intercompany Billing

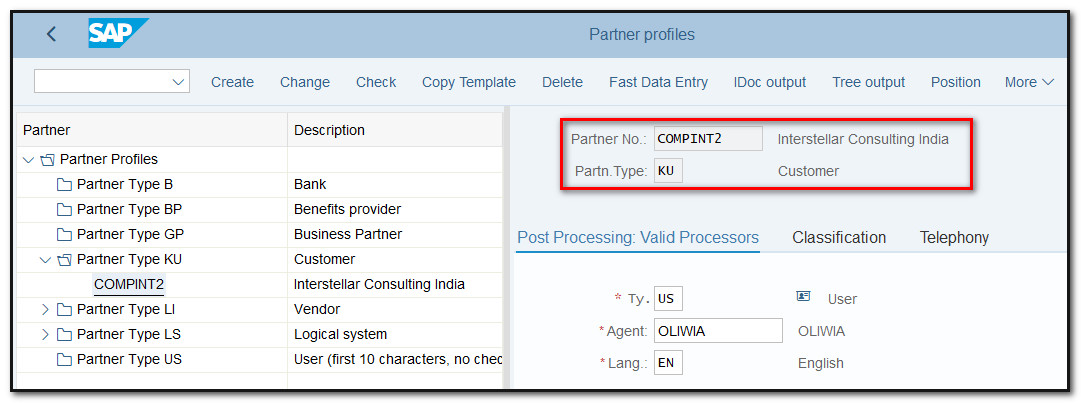

Step 4: For processing vendor invoices using EDI in intercompany billing scenario, it is necessary to setup a partner profile for customers and vendors. (T-code: WE20)

This step is covered in details in the article "Partner Profile settings for output RD04".

Figure 4 Partner Profile creation, customer

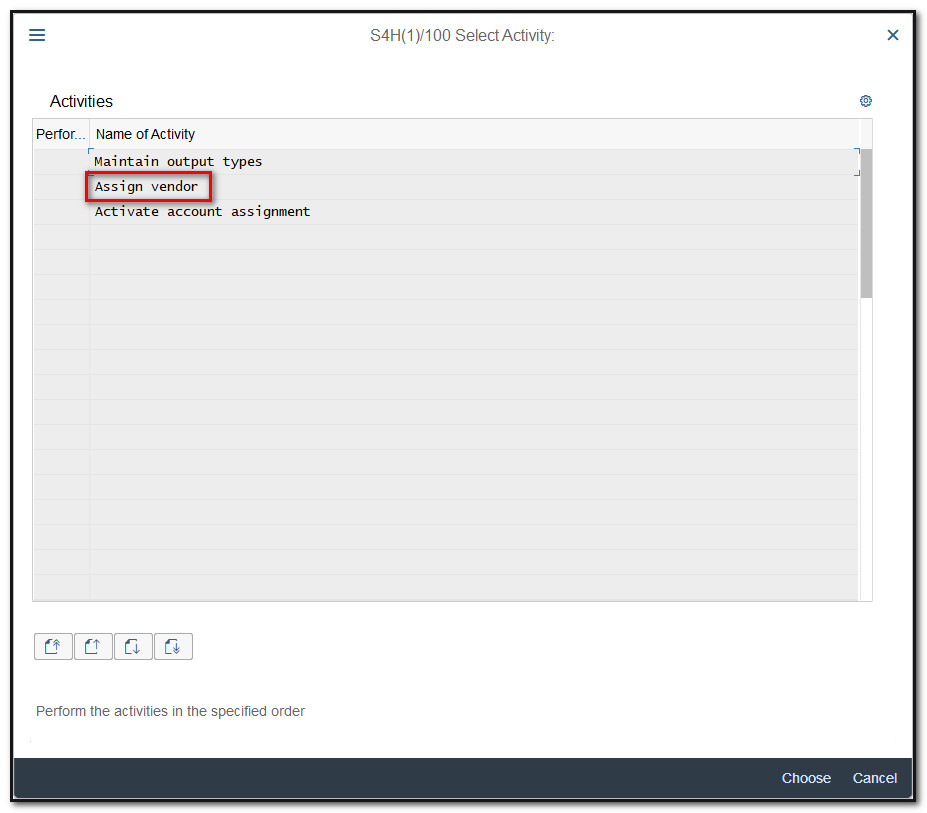

Step 5 : For every company code and IC customer, a vendor must be assigned. You can do this assignment in Customizing.

Menu Path:

SAP Customizing Implementation Guide ➢ Sales and Distribution ➢ Billing ➢ Intercompany Billing ➢ Automatic Posting To Supplier Account (SAP-EDI)

Figure 5 Automatic Posting To Supplier Account, selection view

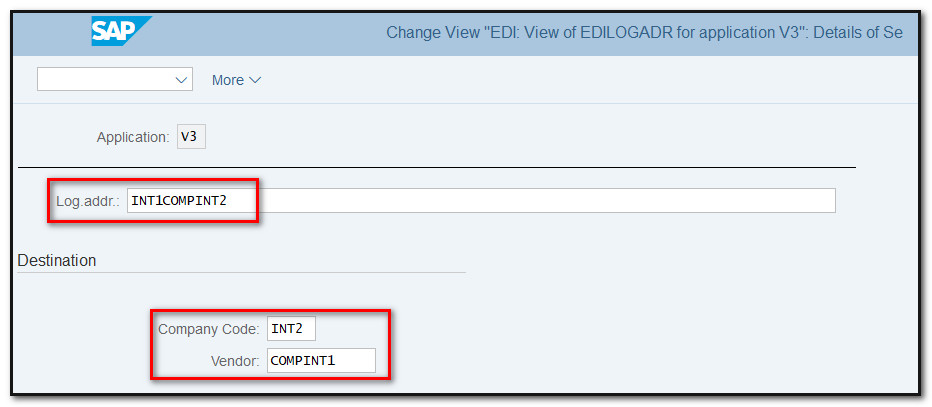

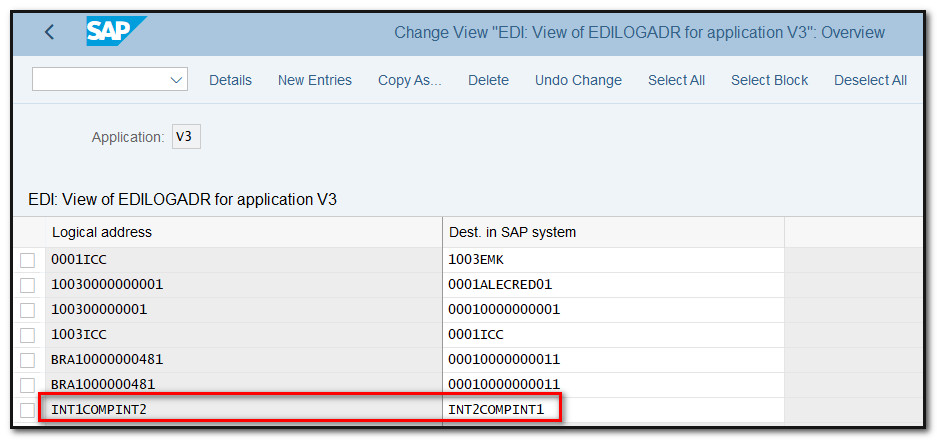

Settings:

Application: V3

Logical address INT1COMPINT2

This consists of:

a) Delivering company code consisting of four digits: INT1

b) Customer number consisting of ten digits: COMPINT

Destination:

Company code: INT2

Vendor: COMPINT1

Figure 6 Automatic Posting To Supplier Account, logical address

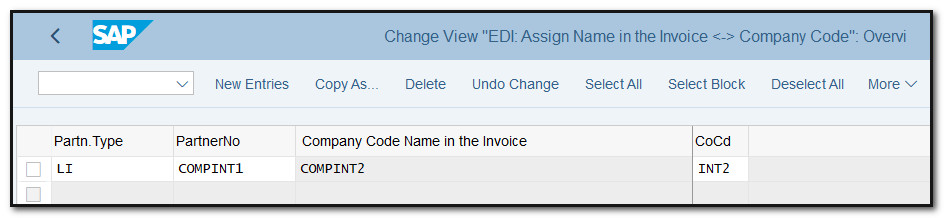

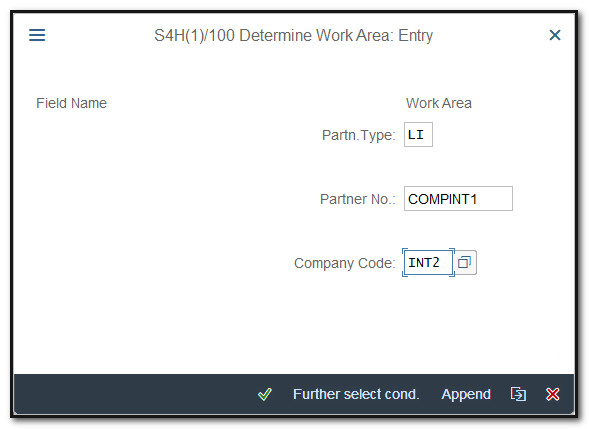

Step 6 : The name that your IDoc partner uses on invoices to your company must be assigned to the company code specified for this (Tcode OBCA)

Menu Path:

SAP Customizing Implementation Guide ➢ Materials Management ➢ Logistics Invoice Verification ➢ Electronic Data Interchange (EDI) ➢ Assign Company Code

Figure 7 EDI, Company Code assignment

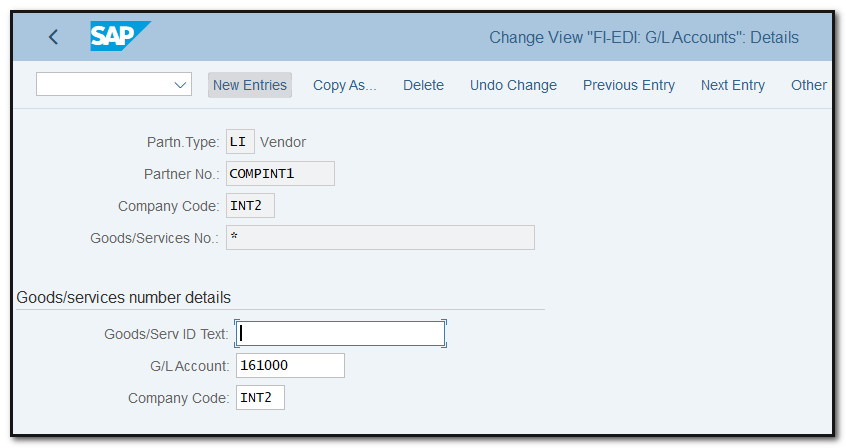

Step 7 : Enter the G/L account for the expense account posting or revenue posting and the company code to which the expense account or revenue is to be assigned for each EDI partner and invoice company code (company code for the vendor) (Tcode OBCB).

Menu Path:

SAP Customizing Implementation Guide ➢ Financial Accounting ➢ Accounts Receivable and Accounts Payable ➢ Business Transactions ➢ Incoming Invoices/Credit Memos ➢ EDI ➢ Assign G/L Accounts for EDI Procedures

Enter Partner Type LI, Partner number and company code.

Figure 8 EDI, G/L Account assignment

The name of the good or service in the EDI invoice determines the G/L account for those items. The condition key and the condition plus-minus sign (+ for surcharge, - for reduction) determine the G/L account for price increases and decreases.

The system generates a cross-company code posting if the invoice company code and the G/L account company code are different.

Figure 9 EDI, G/L Account assignment - details

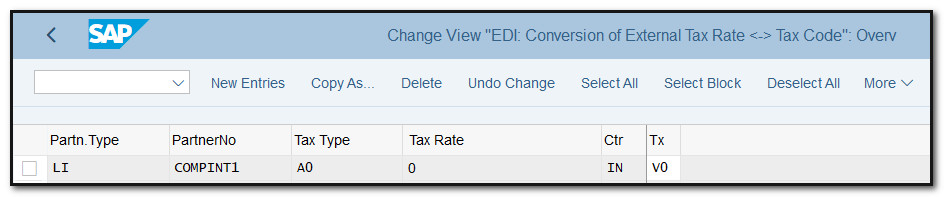

Step 8: For each EDI partner, you assign the tax code defined in the SAP System to the tax type and the tax rate determined by that partner (Tcode OBCD).

Menu Path:

SAP Customizing Implementation Guide ➢ Financial Accounting ➢ Accounts Receivable and Accounts Payable ➢ Business Transactions ➢ Incoming Invoices/Credit Memos ➢ EDI ➢ Assign Tax Codes for EDI Procedures

These can be assigned in accordance with the location of the vendor account in the country of the invoice recipient (i.e., the country of the company code).

- Leave the country field empty if you want to create the assignment independently of the country.

- Enter VAT as the tax type if you want to make the assignment without regard to the tax type. The tax rate is used to calculate the tax code.

Figure 10 EDI, Conversion of External Tax Rate

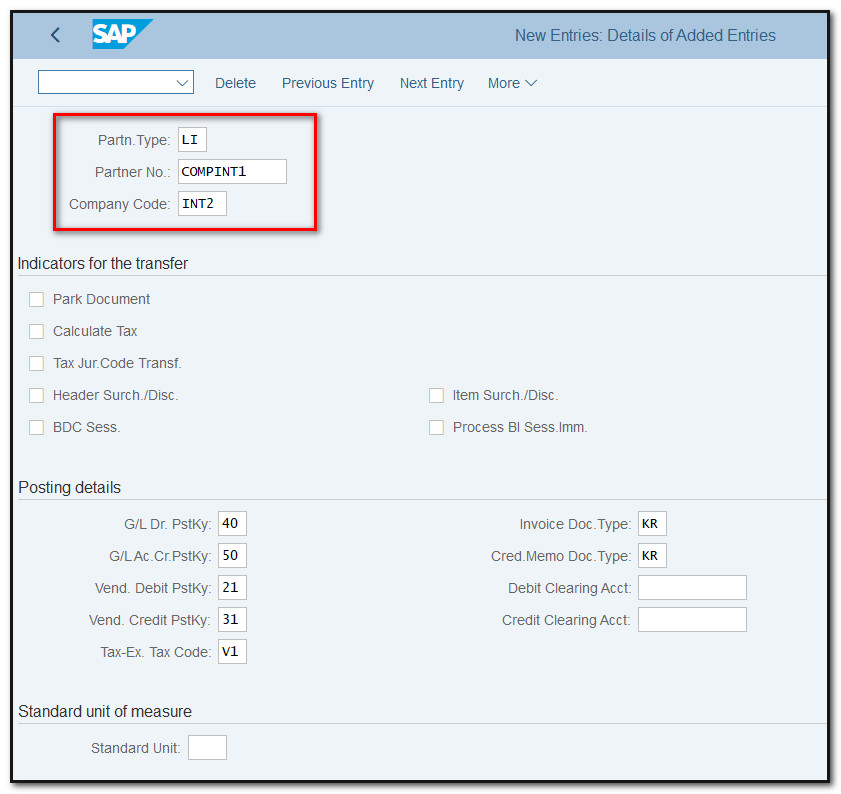

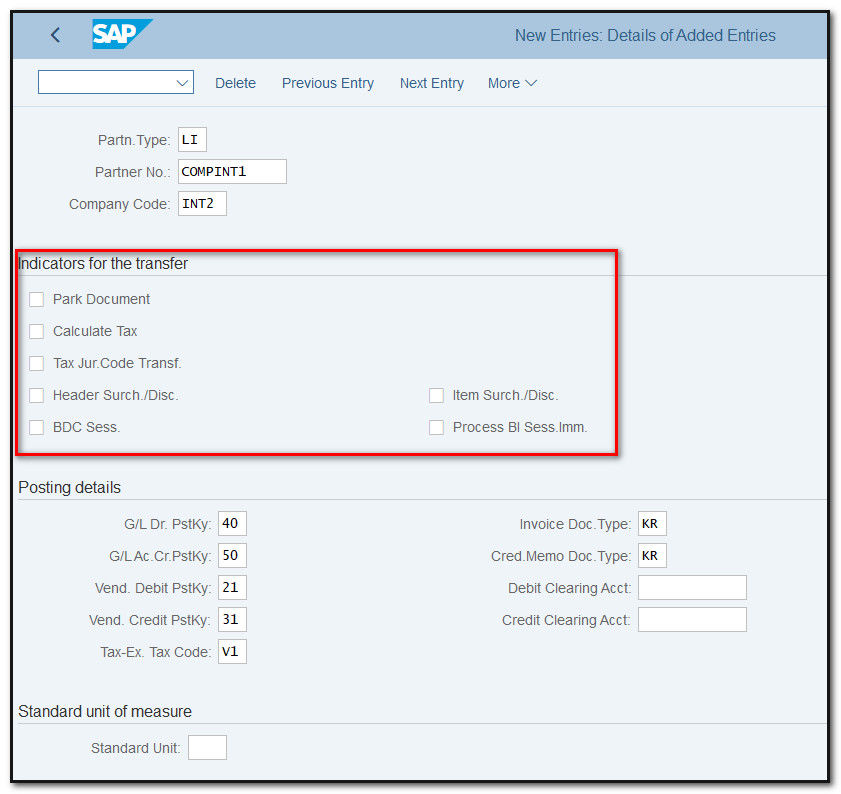

Step 9 : For each EDI partner and invoice company code, you enter parameters for the content and the procedure, which determine how the EDI invoices are posted in the system (Tcode OBCE).

Menu Path:

SAP Customizing Implementation Guide ➢ Financial Accounting ➢ Accounts Receivable and Accounts Payable ➢ Business Transactions ➢ Incoming Invoices/Credit Memos ➢ EDI ➢ Enter Program Parameters for EDI Incoming Invoice

Enter Partner Type LI, Partner number and company code.

Figure 11 EDI, Program Parameters assignment

You can enter the following for processing:

- Calculate tax - If you choose this field, the system will calculate the tax. If not, it applies the tax described in the EDI invoice.

- Transferred tax jurisdiction code - Select this field if the tax jurisdiction code is transferred in the EDI invoice.

- Surcharges/reductions at header level - Select this field to allow the posting of surcharges or reductions at the totals level if they are transferred in the EDI invoice header.

- Park document - The document is only parked in Accounts Payable Accounting if this field is chosen. Or else, it is posted there.

- BDC session - When you park or post documents, the system establishes a batch-input session if this field is selected. In every other case, Accounts Payable Accounting receives a straight posting of the EDI invoice.

Note

➢ Regardless of this setting, the system also starts a batch-input session if an EDI invoice generates more than 949 posting lines, which results in the creation of multiple FI documents. This is because when multiple documents are posted at once, the system is unable to guarantee that the invoice gets posted or posted completely.

➢ The system will always directly post the document when you use the transfer pricing option.

- Surcharge/reduction at totals level - Surcharges or reductions that were decided on the invoice items are shown in separate document lines if you choose this option.

Figure 12 EDI, Program Parameters assignment, Indicators for the Transfer

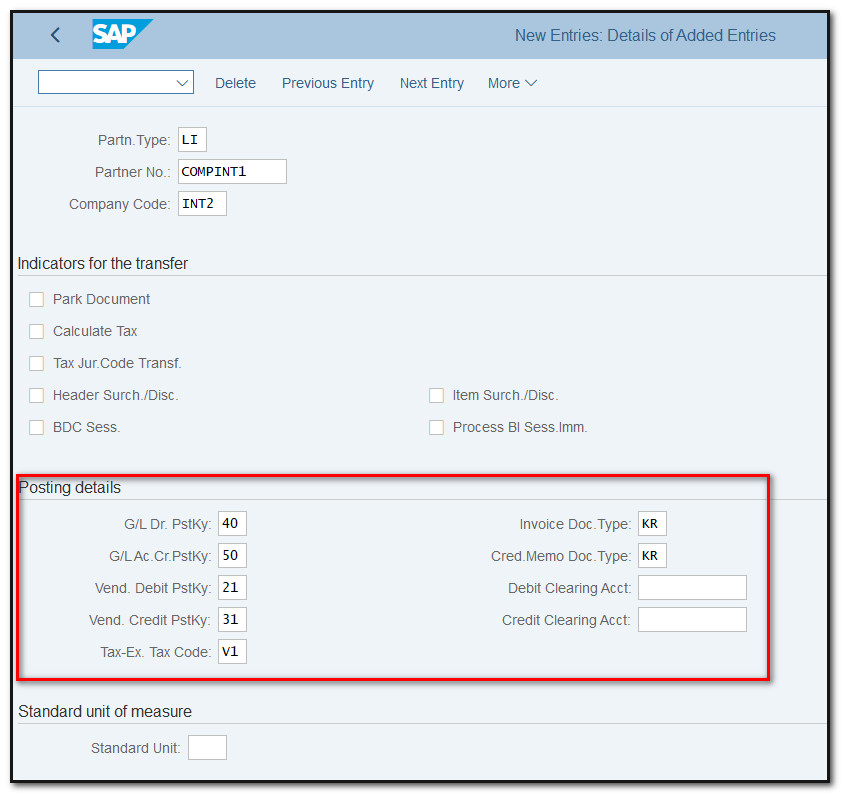

In the Posting Details, specify the following:

- G/L Account Debit Posting Key

- G/L Account Credit Posting Key

- Vendor Debit Posting Key

- Vendor Credit Posting Key

- Tax Code for Tax-Exempt Transactions

- Which type of document the system should use when an IDoc invoice is sent

- Which type of document the system should use when sending a credit memo via IDoc

Figure 13 EDI, Program Parameters assignment, Posting Details

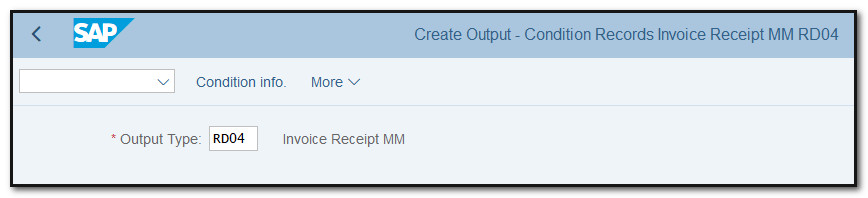

Step 10 : Maintain output condition records for output type RD04 (Tcode VV31)

Figure 14 Condition Record creation

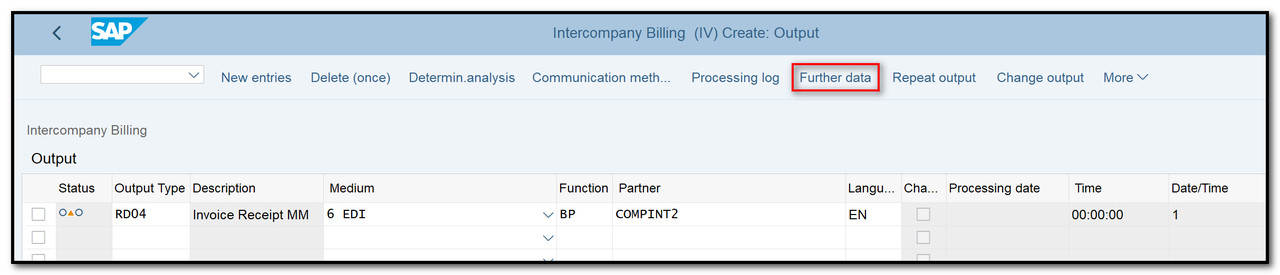

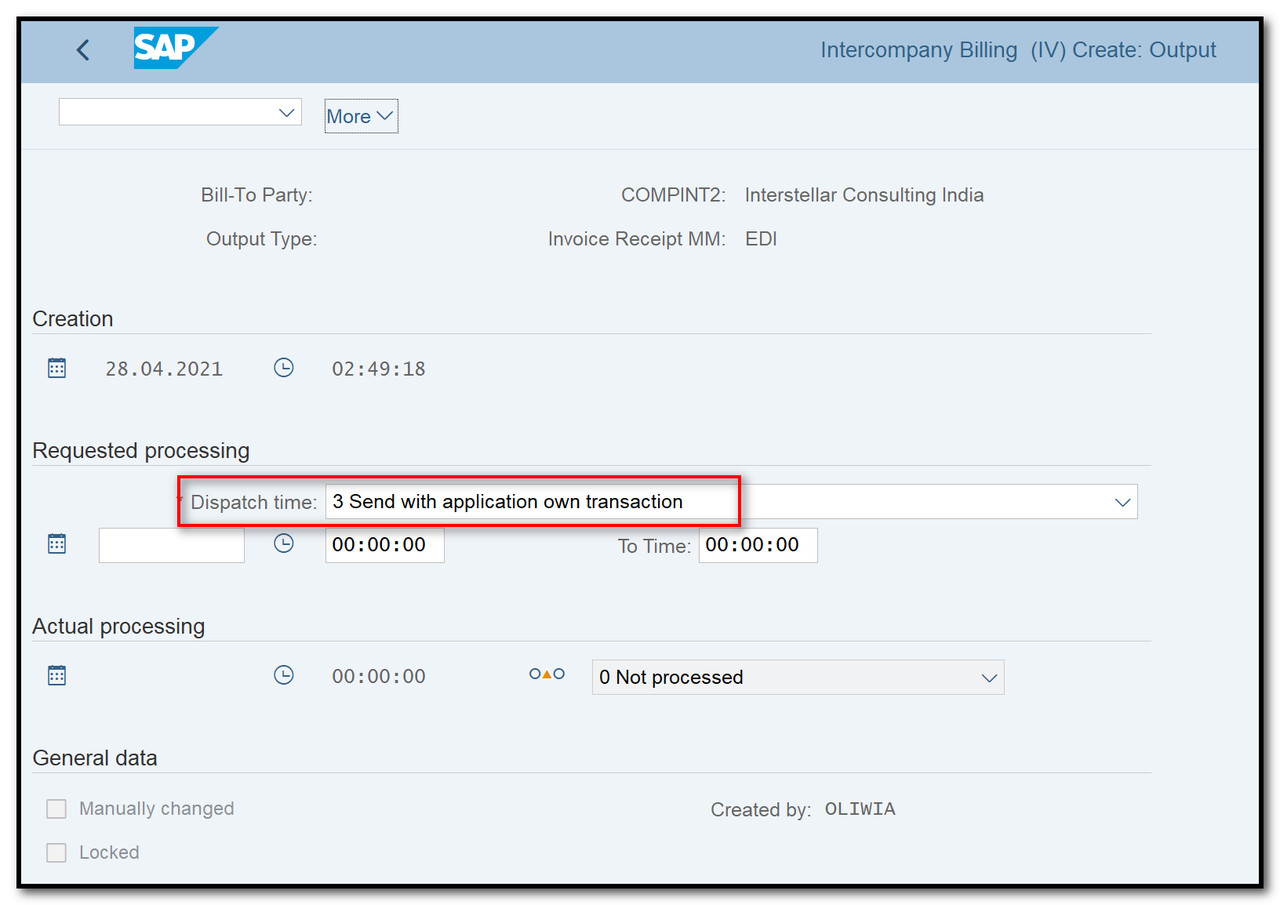

Step 11: Create an intercompany billing to check the output outcome. You can alter the Dispatch time to 3 Send with application own transaction in Further data for the output type if you want to look into the specifics of output processing.

Process the output using VF31 after that.

Figure 15 Intercompany Billing, Output details

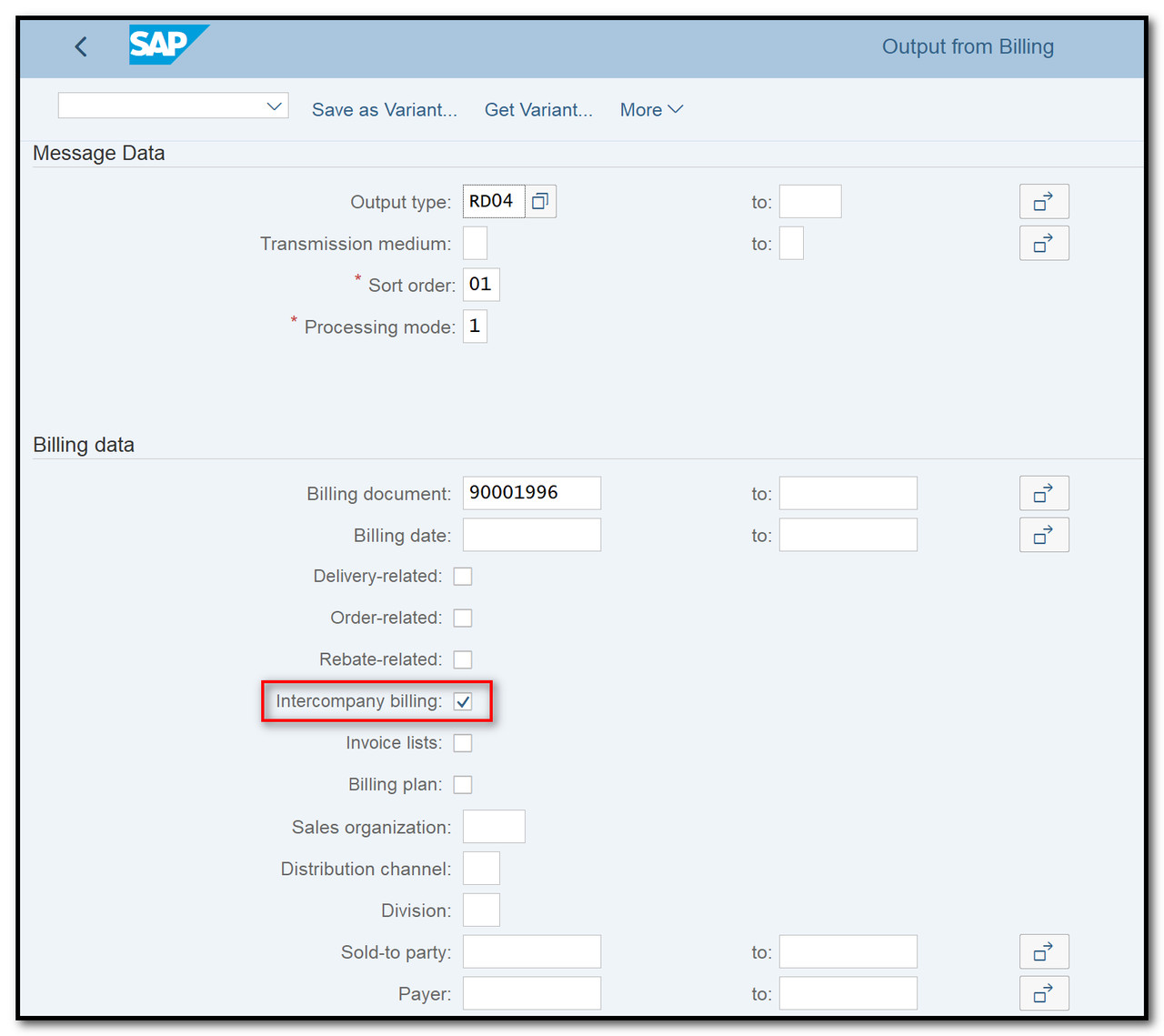

Step 12: Run VF31 to process this output.

Figure 16 Output Processing, selection view

Figure 17 Output Processing screen

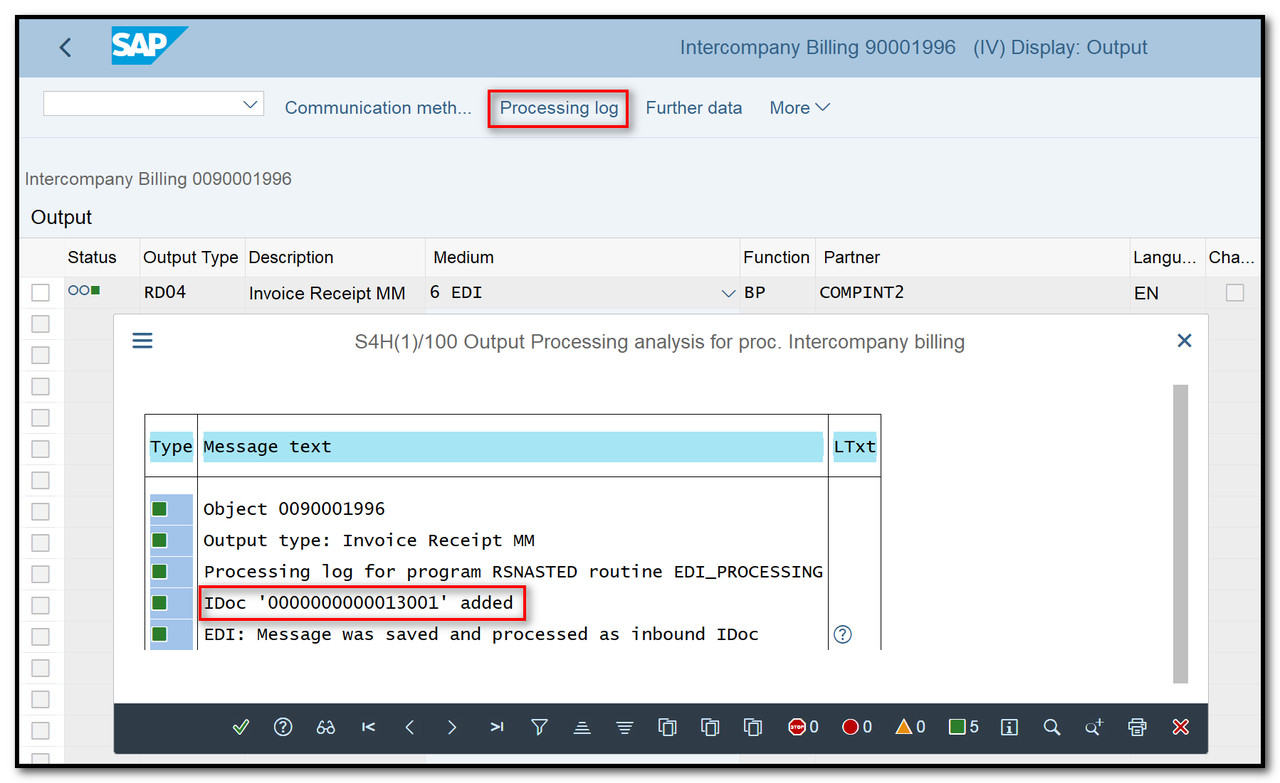

Analyze the output processing using VF03's Processing Log. If there was a mistake in the output processing in transaction code WE02, you can examine it here along with the IDOC number created from the output.

Figure 18 Processing Log of billing output